The Definitive Guide to Pvm Accounting

The Definitive Guide to Pvm Accounting

Blog Article

Not known Facts About Pvm Accounting

Table of ContentsPvm Accounting Can Be Fun For EveryoneUnknown Facts About Pvm AccountingWhat Does Pvm Accounting Do?Get This Report on Pvm AccountingPvm Accounting - QuestionsMore About Pvm AccountingTop Guidelines Of Pvm Accounting

In regards to a firm's overall approach, the CFO is accountable for leading the company to satisfy economic goals. A few of these approaches can entail the business being gotten or acquisitions going ahead. $133,448 each year or $64.16 per hour. $20m+ in annual income Service providers have developing requirements for workplace supervisors, controllers, bookkeepers and CFOs.

As a service expands, bookkeepers can maximize extra team for various other company responsibilities. This could ultimately cause boosted oversight, greater accuracy, and better compliance. With more resources following the trail of money, a service provider is much a lot more likely to make money accurately and on schedule. As a building and construction firm grows, it will certainly require the aid of a full-time financial staff that's managed by a controller or a CFO to handle the firm's funds.

The 10-Minute Rule for Pvm Accounting

While large companies may have full-time economic support groups, small-to-mid-sized businesses can employ part-time accountants, accountants, or monetary consultants as required. Was this write-up valuable?

As the construction market remains to thrive, services in this field must preserve solid economic management. Efficient accounting methods can make a substantial difference in the success and growth of building firms. Let's discover 5 important audit methods customized especially for the building and construction industry. By executing these methods, building and construction businesses can improve their monetary stability, streamline operations, and make informed decisions - construction taxes.

In-depth quotes and budgets are the foundation of building and construction project management. They help steer the project towards timely and successful completion while safeguarding the passions of all stakeholders included. The essential inputs for project price estimate and budget plan are labor, materials, equipment, and overhead expenditures. This is generally among the largest costs in building projects.

Fascination About Pvm Accounting

An accurate evaluation of products required for a task will certainly aid guarantee the needed products are acquired in a timely way and in the ideal amount. An error below can lead to wastefulness or hold-ups due to material shortage. For many building and construction tasks, tools is needed, whether it is bought or rented out.

Proper equipment evaluation will certainly aid make certain the best devices is readily available at the correct time, saving money and time. Do not forget to represent overhead costs when estimating job expenses. Straight overhead costs are details to a project and might consist of short-term leasings, utilities, fence, and water materials. Indirect overhead costs are day-to-day costs of running your company, such as lease, management incomes, utilities, taxes, depreciation, and marketing.

One various other aspect that plays into whether a project is effective is an exact quote of when the project will certainly be finished and the associated timeline. This estimate aids make certain that a job can be ended up within the allocated time and resources. Without it, a job may lack funds prior to completion, creating prospective job deductions or desertion.

What Does Pvm Accounting Do?

Precise job setting you back can assist you do the following: Understand the earnings (or do not have thereof) of each job. As work costing breaks down each input right into a task, you can track success independently. Compare actual expenses to estimates. Handling and analyzing quotes permits you to far better price tasks in the future.

By identifying these items while the project is being completed, you stay clear of surprises at the end of the job and can resolve (and with any luck avoid) them in future projects. Another tool to help track tasks is a work-in-progress (WIP) routine. A WIP routine can be finished monthly, quarterly, semi-annually, or each year, and consists of project information such as agreement worth, sets you back sustained to date, overall estimated expenses, and overall project invoicings.

Rumored Buzz on Pvm Accounting

Budgeting and Forecasting Devices Advanced software application uses budgeting and forecasting capacities, allowing building and construction business to intend future jobs extra precisely and manage their financial resources proactively. Document Monitoring Construction tasks involve a whole lot of documentation.

Enhanced Vendor and Subcontractor Administration The software application can track and take care of repayments to suppliers and subcontractors, making sure timely repayments and maintaining good partnerships. Tax Prep Work and Filing Accountancy software application can aid in tax obligation prep work and declaring, making sure that all relevant monetary activities are accurately reported and taxes are submitted on schedule.

The 20-Second Trick For Pvm Accounting

Our customer is an expanding growth and building and construction firm with head office in Denver, Colorado. With several energetic building and construction tasks in Colorado, we are searching for an Accounting Aide to join our group. We are seeking a full time Accounting Aide that will be accountable for offering useful support to the Controller.

Get and review daily billings, subcontracts, change orders, purchase orders, inspect demands, and/or other associated paperwork for efficiency and compliance with monetary plans, treatments, spending plan, and contractual requirements. Precise handling of accounts payable. Get useful source in billings, approved draws, order, etc. Update month-to-month evaluation and prepares spending plan trend reports for building projects.

Getting My Pvm Accounting To Work

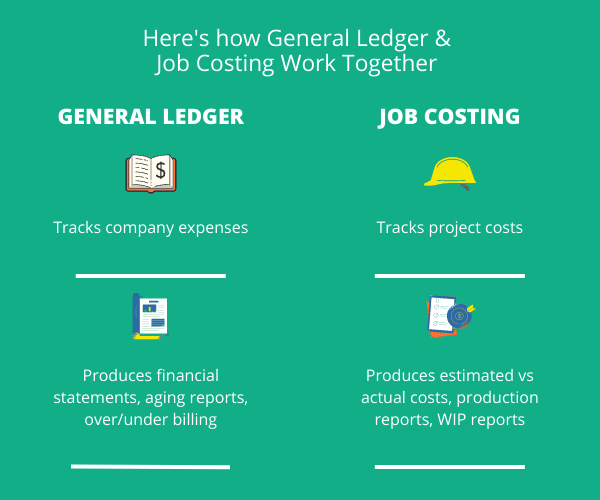

In this overview, we'll dive right into different aspects of building accountancy, its value, the requirement devices made use of in this location, and its duty in construction projects - https://dzone.com/users/5145168/pvmaccount1ng.html. From economic control and price estimating to cash flow administration, discover how bookkeeping can benefit building jobs of all ranges. Building accountancy describes the customized system and processes utilized to track monetary information and make critical choices for building and construction businesses

Report this page